Get approved for Autobooks Capital

NOTE: Autobooks Capital is not available to all Autobooks users. If Autobooks Capital is not present in your Autobooks account, you may not qualify for Autobooks Capital OR your financial institution may not offer it.

For customers in Texas, funding is in the form of a line of credit with a fixed payment structure. All details in this article may not apply to Texas customers.

How to apply for Autobooks Capital

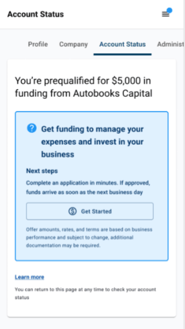

If you're eligible for an Autobooks Capital advance line, you'll see messages within Autobooks that you're pre-qualified.

The application process from there is simple. Just navigate to the Capital tab (or click Get Started within any pre-qualification message), then follow the prompts to formally apply (if you don't see the Capital tab, we're not able to offer you an advance line at this time).

You may be asked to provide further details about your business to finalize the review of your application. Complete all questions that appear in the pop-up on screen.

You'll be notified via email once an approval decision has been made.

You'll also see information about the approval decision within Settings > Account Status.

Additional data verification or documentation

You may be asked to confirm certain data about you or your business after the initial application to help us make an approval decision. In addition, you may need to submit documentation to support the approval process.

If you are asked for either of these for your Capital line approval, log in to Autobooks and click on the Capital tab. You'll see instructions on how to proceed.

Autobooks Capital approval vs Digital Payment Processing approval

The approval process for an Autobooks Capital advance line is separate and distinct from our approval for your business to accept digital payments using Autobooks payment tools.

Why?

For Capital advance line approval, your transaction history and average account balance is taken into consideration for your ability to repay any advances you draw, as well as the total dollar amount of your advance line.

For Digital Payment Processing approval, Autobooks evaluates your business type, online presence, and other business factors to allow you to take digital payments using Autobooks tools safely and securely. To learn more about applying for payment processing, click here.

To make a credit decision for either Capital or payment processing, we will do a soft credit pull which does not impact your personal credit score.