Create a new vendor invoice or vendor credit

This feature is available only for those that subscribe monthly to our Accounting and Reporting services.

If you are NOT a monthly subscriber and would like more information, please view: How to upgrade to add Accounting and Reporting features to my Autobooks account.

A vendor invoice is a bill from a vendor that you would like to manually record within Autobooks.

A vendor credit is a credit against a bill from a vendor. For example, a vendor may have offered you a discount on your original invoice and you want to note that accordingly.

To create a new vendor invoice or vendor credit, navigate to the Pay Bills or Vendor section of Autobooks (the name of the section will depend on Bill Pay availability allowed by your financial institution). Click the Vendor Invoices tab, then click the New vendor invoice button.

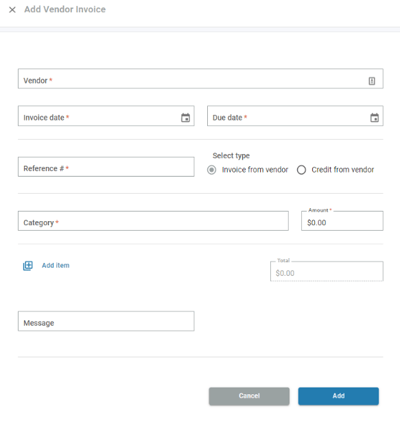

From this page, you will need to enter the following information:

- Vendor - name of the business that you received this invoice (or credit) from

- Invoice date or Credit date

- Due date

- Reference number - the reference or account number from your vendor account

- Select Type - to indicate whether this is a vendor invoice or vendor credit

- Accounting category to code this invoice (or credit) against

- Amount - dollar amount of the invoice or credit

- Message (optional)

Click Add to save this vendor invoice or vendor credit.