Manage Vendor Invoices

This feature is available only for those that subscribe monthly to our Accounting and Reporting services.

If you are NOT a monthly subscriber and would like more information, please view: How to upgrade to add Accounting and Reporting features to my Autobooks account.

A vendor invoice is a bill from a vendor that you would like to manually record within Autobooks.

A vendor credit is a credit against a bill from a vendor. For example, a vendor may have offered you a discount on your original invoice and you want to note that accordingly.

Both vendor invoices and vendor credits can be created by clicking the New vendor invoice button. See the article Creating a new vendor invoice/credit for more information.

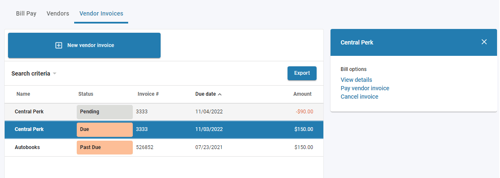

Click on a specific vendor invoice to view the side menu. You can View details of the invoice, Pay vendor invoice (if available through your financial institution), or Cancel invoice.

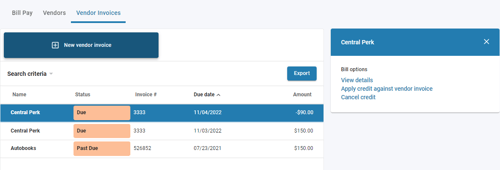

Clicking on a specific vendor credit will bring up the side menu where you can View details of the credit, Apply credit against vendor invoice, or Cancel credit.

Vendor Credits will show as negative dollar amount, since this will be reducing the amount your business owes for a particular vendor invoice once it has been applied.