Understanding Your Settlement Details Report

Autobooks provides a detailed report to help you understand the transactions that make up your deposits.

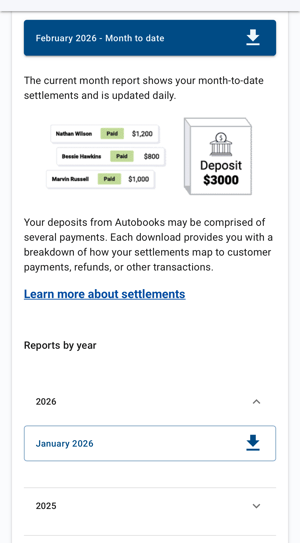

Your deposits from Autobooks may be comprised of several customer payments accepted through either Invoicing or the Payment Link.

The settlement details report shows each deposit, and the customer payments, refunds, and other transactions that make up the deposit.

Downloading the Settlement Details Report

Click Reports in the menu or on a phone or tablet, click the Menu icon within the application (three small horizontal lines), then click Reports to view a list of available reports.

From the report list, click on Settlement Details. You will see a list of reports available for download. Each report contains one months' worth of data, and the current month report will always have month-to-date data to view. The Settlement Details report is accessible to all users.

Click on a monthly report to generate an Excel file for download. The current month will show at the top with past months near the bottom. The report will not be displayed but can be downloaded onto your device and then viewed.

Understanding your Settlement Report

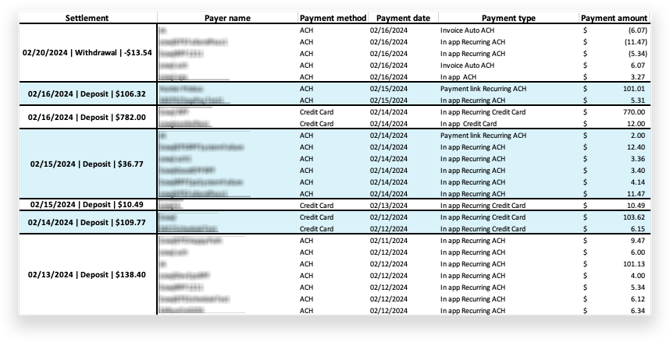

Each column in your settlement report includes information breaking down the payments you've received from Invoicing and Payment Link with Autobooks. View each column header to understand your Settlement Report details.

- Settlement:

- The total amount settled into your account. This may include several customer payments, refunds, or other transactions and the estimated date in which this settlement has posted to your account. (Note* The settlement date could slightly vary).

- Payer Name:

- This is the name on the card or name on the account provided by the payer at the time of the payment.

- Payment Method:

- The type of payment method used (i.e. Credit Card or ACH).

- Payment Date:

- Date in which the payment was initiated by the end customer.

- Note that this date is different than the date of the settlement as it can take 1-2 business days for a payment to process and settle into an account.

- Payment Type:

- This column lists which payment tool with Autobooks a payment was processed and can also note refunds. Examples include Invoice, Payment Link, In-App, Return, Refund Chargeback, etc.

- Payment Amount:

- The amount of the credit or debit made to the account.

- Amounts surrounded in ( ) denote negative amounts.

- Payment Number:

- An ID Number specific to Autobooks. You can use this number to match settlement details inside of the Fee Details report, also available inside of the reports tab.

- Description:

- The value entered by the payers in the "description box" on the payment link.

- Customer:

- This is the name of the customer account that is saved to your customer list.

- Email:

- Email corresponding to the payor / customer.

- Status:

- The current state of a payment or refund within the settlement report. The default status is Settled, however if a payment is returned or refunded, the status will show as Refund.

This settlement report cannot be pulled prior to February 2024.