Understanding your Bank Reconciliation report

In most accounting systems, bank reconciliation is a manual process where you'd compare your bank and credit card statements to the information you have in your accounting system.

Our Bank Reconciliation report shows items where we see the difference between your bank balance and your balance sheet cash.

Click into any line to see the transactions that make up that line item total.

Using your report

The report search criteria can be changed to the date range you wish to view. Just click the arrow besides Search criteria at the top of the report, then select your desired date range.

If the bank balance we report is not the most recent balance due to changes at your financial institution, you may edit the balance that appears on the report. Just click Edit the ending bank balance to update. Your report can also be exported by clicking Export.

You can identify those transactions that have not cleared (still a book transaction and not an official bank transaction). If you believe the uncleared transaction will not settle to your bank account, you can click the Make exception option to the right of the deposit details.

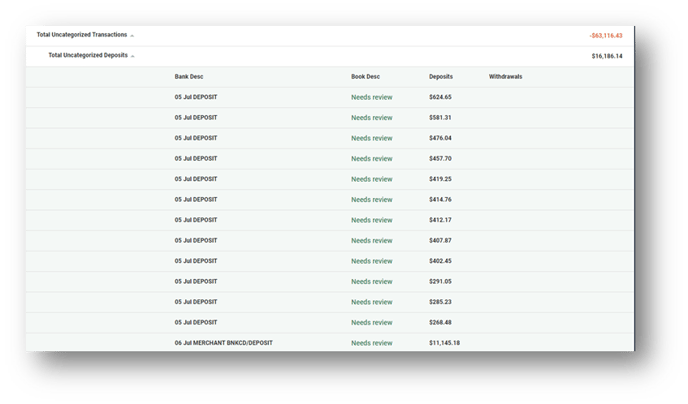

You can view all unaccounted bank transactions (those transactions that are not Matched, not Categorized, or not Excluded previously) by expanding the Total Uncategorized Transactions section of the report. The Needs review link for each item will take you back to the Categorize transaction feature within Accounting to take action as needed (learn how to categorize transactions here).

Tip: Your ending bank balance for a given month will be your beginning bank balance for the next month. To edit your beginning bank balance, go to the prior month and edit the ending bank balance.